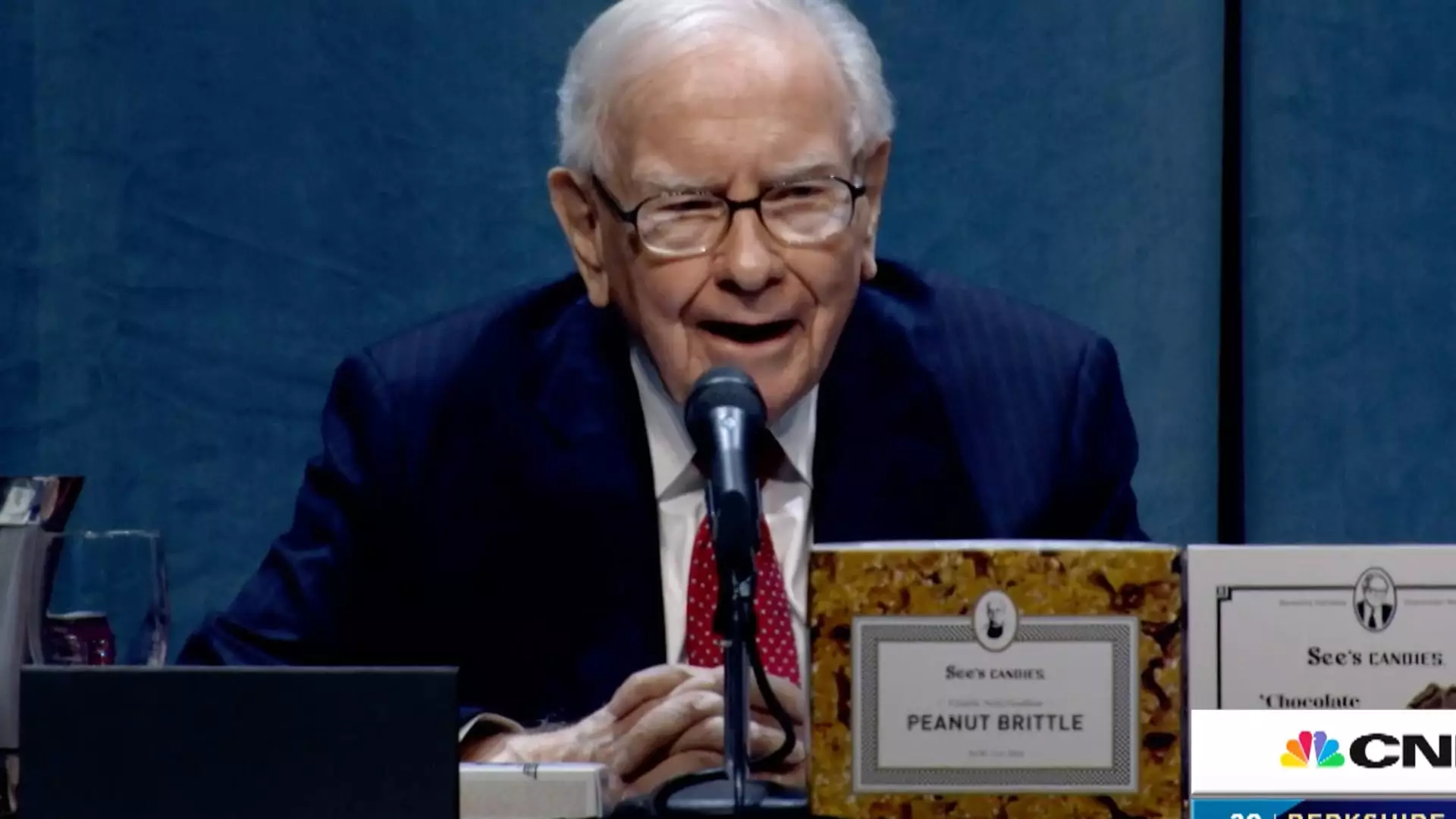

In a rare interview, Warren Buffett, the renowned investor and chairman of Berkshire Hathaway, weighed in on President Donald Trump’s approach to tariffs, a topic that has stirredUp significant debate among economists and investors alike. Buffett, often referred to as the “Oracle of Omaha,” highlighted the potential adverse consequences of such financial policies, suggesting they could result in inflationary pressures that might ultimately disadvantage consumers. Known for his pragmatic views, Buffett noted that tariffs could be seen as a form of economic warfare, emphasizing their broader implications on trade dynamics globally.

While speaking with CBS News’ Norah O’Donnell, Buffett remarked humorously about the nature of tariffs, stating, “Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” This light-hearted comment underscores a critical understanding of tariffs as costs that are inherently passed on to consumers—an essential consideration in the field of economics that often gets overlooked amid political rhetoric.

The Broader Economic Context

Buffett’s comments come at a pivotal moment when trade tensions are escalating, particularly with China, following Trump’s plans to impose significant tariffs of 25% on imports from Canada and Mexico, along with a 10% levy on goods from China. These decisions raise the specter of retaliation and potentially a tit-for-tat trade war, creating uncertainties in global markets. Buffett, whose investment decisions influence countless investors, firmly believes in the need to analyze the long-term fallout of such economic strategies, encapsulated in his repeated question, “And then what?”

This public commentary marks Buffett’s first significant engagement regarding current trade policies, diverging from his previous vocal opposition to aggressive tariffs during Trump’s earlier years in office. He had previously warned of the potential repercussions that could ripple through the global economy. His cautious stance, particularly as he has recently liquidated substantial stock holdings in exchange for cash reserves, reflects an acute awareness of market volatility and its risks.

The Implications for Investors

With the S&P 500 seeing only a modest increase and the market embroiled in uncertainty—affected not only by trade disputes but also by mounting worries over economic growth—Buffett’s actions have led many to speculate whether his moves signify a bearish outlook. Some interpret his strategy as a means to safeguard his conglomerate’s future in preparation for new leadership, as the business faces a new era post-Buffett.

Buffett’s reserved remarks regarding the broader economy also reveal a strategic mindset. He chooses to abstain from making direct predictions, which could further destabilize market sentiments. His decision to hold hefty cash reserves may indicate a classic Buffett approach—waiting for the right moment to invest when opportunities arise, especially in times of market downturns.

In essence, Warren Buffett’s candid insights provide a nuanced understanding of the implications of tariffs on both the economy and consumer behavior. His awareness of the interconnectedness of global trade dynamics and his strategies for navigating uncertainties offer invaluable lessons for both seasoned investors and those new to the financial landscape. As market conditions continue to evolve, it is clear that Buffett’s opinions will remain crucial in shaping the discourse around economic policies and investment strategies.