The Consumer Financial Protection Bureau (CFPB) has always played a crucial role in safeguarding consumer financial interests in the United States. However, recent political upheavals signal an uncertain future for the agency, prompting discussions about its viability and effectiveness. A recent internal memo revealed that employees were instructed to work remotely, indicating a significant operational shift amidst efforts to curtail the bureau’s activities. The interplay between political agendas and consumer protection raises pressing questions about the future of financial regulation in the country.

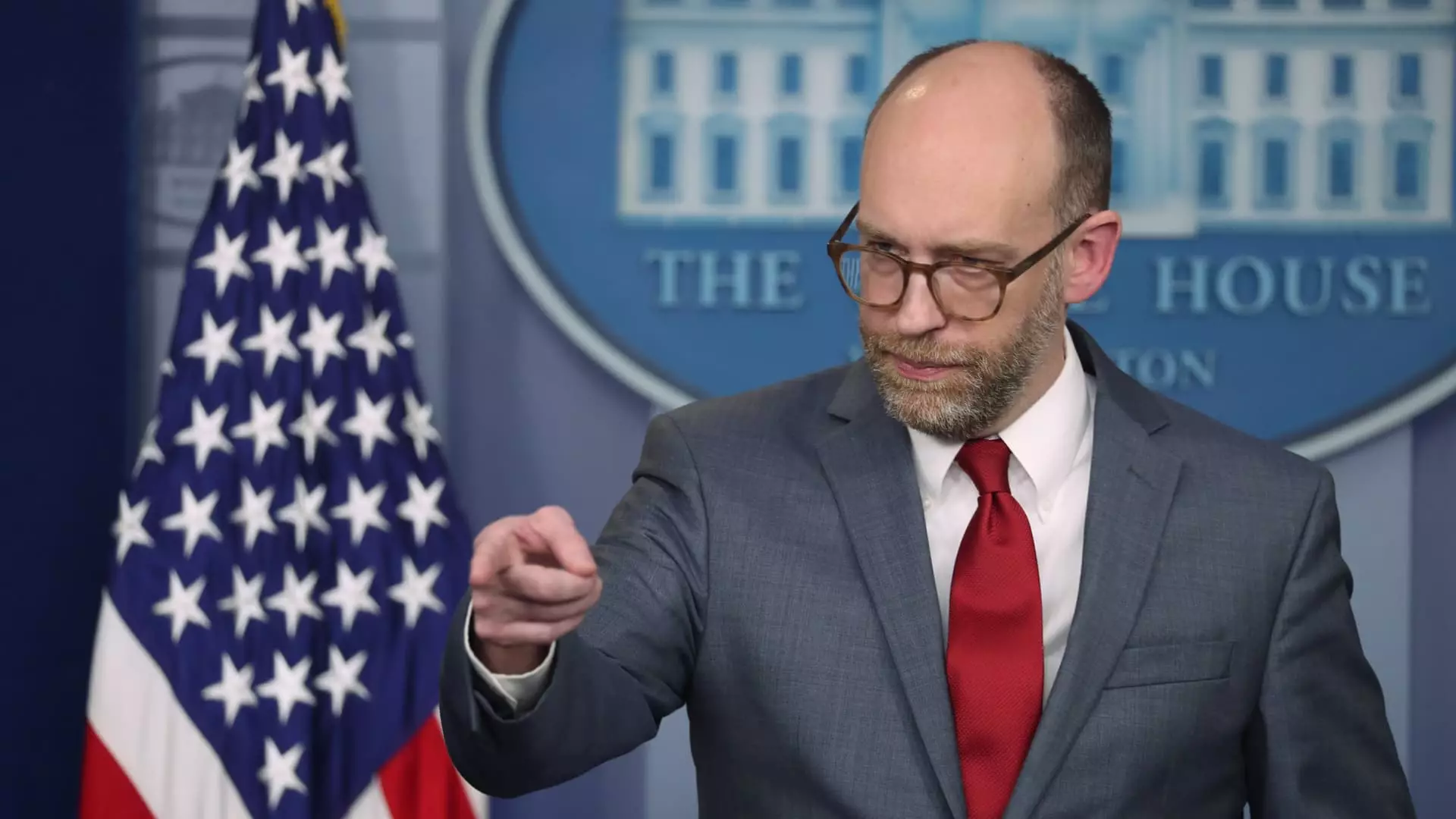

In a sudden turn of events, Chief Operating Officer Adam Martinez informed CFPB employees that they would be operating remotely until February 14, following an email from new acting director Russell Vought. This directive comes at a time when Vought has mandated a halt on nearly all regulatory functions, including the supervision of financial firms. Such drastic steps have fueled anxiety among the approximately 1,700 employees who fear potential layoffs or administrative leave, reminiscent of previous actions taken against other federal agencies under the Trump administration.

Vought’s recent memos have implied a concerted effort to reduce the CFPB’s operational capacity, putting into question the agency’s longstanding role in monitoring financial institutions. Employees, fearing for their jobs, are left in limbo as they await clearer directives on the future of the bureau. The potential for massive layoffs raises alarms not just for the staff but for consumers who depend on the agency’s watchful eye over the financial sector.

Adding another layer of complexity to the situation, operatives associated with Elon Musk’s DOGE have gained access to CFPB data, further complicating the agency’s governance. Musk, who has previously expressed disdain for the CFPB and even suggested its disbandment, has exacerbated the concerns of agency staff and advocates alike. His social media actions, including a dismissive post labeling the agency as “CFPB RIP,” highlight a troubling trend where powerful individuals attempt to influence government functions with their personal agendas.

The collaboration between Musk’s representatives and the CFPB raises eyebrows over data security and the integrity of the bureau’s operations. Such developments underscore the potential consequences of intertwining corporate interests with regulatory oversight, which could deter the agency from its core mission of protecting consumers from financial abuses.

Historically, the CFPB has been a stalwart defender of consumers, tasked with preventing financial exploitation and ensuring fair practices in the banking sector. During the aftermath of the 2008 financial crisis, the bureau emerged to address shortcomings in regulation that allowed predatory practices to flourish. However, the recent developments threaten to dismantle years of progress. Initiatives aimed at limiting exorbitant credit card fees and protecting consumers from predatory medical debt reporting are now at risk.

Banking trade associations have long criticized the CFPB, asserting that its rules are overly punitive and hinder market competition. Their attempts to challenge the agency in court have been relentless, even questioning its constitutionality. As the agency faces potential budget cuts and operational paralysis, the consumer protections that millions rely on may be jeopardized.

The trajectory of the CFPB appears precarious amidst this political tumult. The agency’s ability to fulfill its mission is under siege from forces both external and internal. With mass layoffs looming and key initiatives on the chopping block, the implications for consumer protection in America could be profound.

As stakeholders from various sectors weigh in on this unfolding drama, it becomes increasingly clear that the fate of the CFPB hinges on broader governmental philosophy and public sentiment regarding consumer rights in financial markets. The coming weeks and months will likely be pivotal in determining whether the CFPB can retain its relevance or if it will slowly fade into obscurity, leaving consumers vulnerable once again to the whims of financial institutions.