Eli Lilly has taken significant strides in the burgeoning weight management drug market with its latest introduction of higher doses of the weight loss medication Zepbound. By offering Zepbound in single-dose vials at a notably reduced price, Eli Lilly aims to provide broader access to this innovative treatment, particularly for patients who may not have insurance coverage. This strategic shift addresses an urgent demand for effective obesity treatments amid rising health concerns linked to obesity and related comorbidities, such as obstructive sleep apnea.

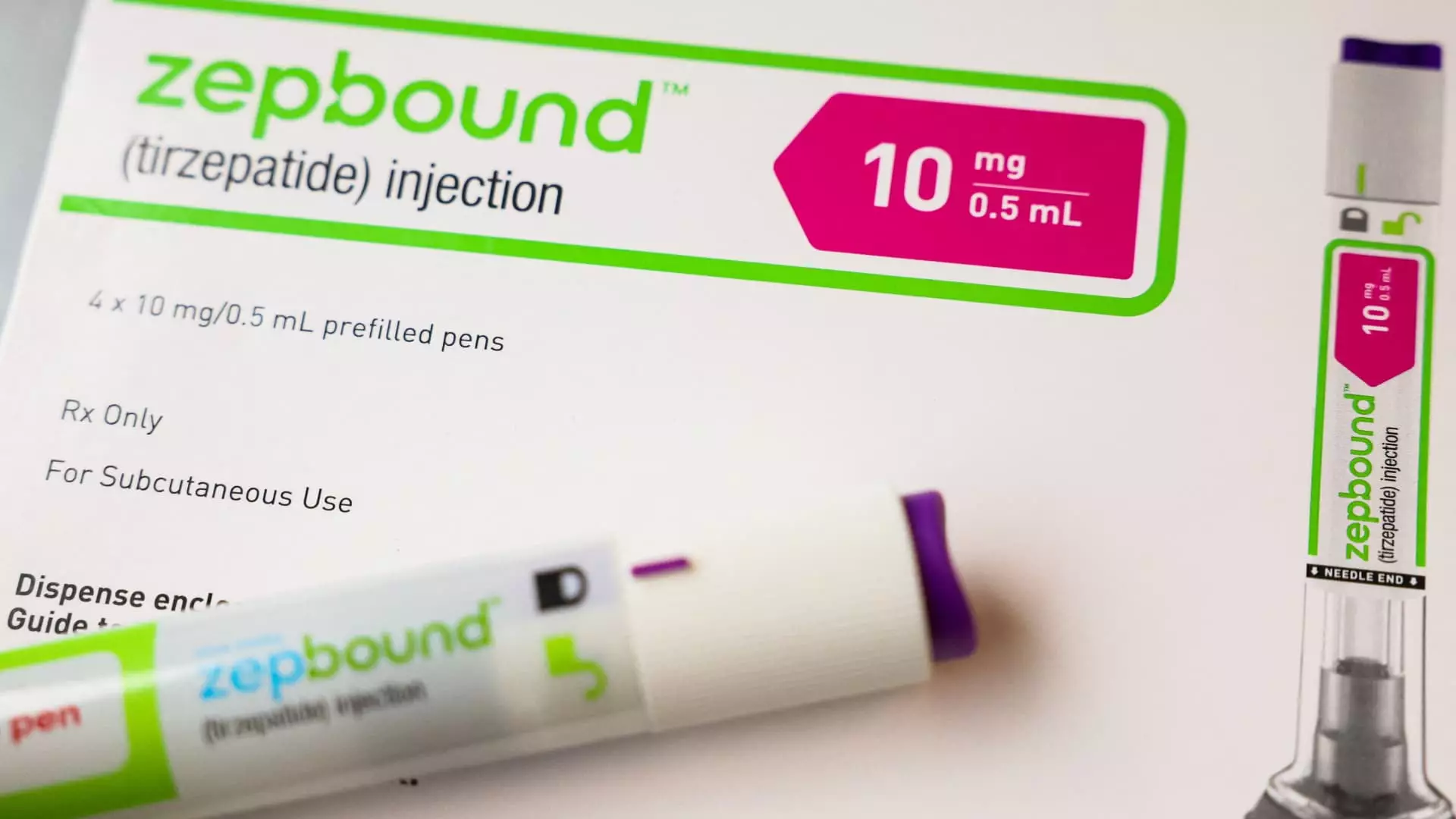

The newly announced pricing strategy is particularly noteworthy. Eli Lilly is introducing higher doses of Zepbound in both 7.5 mg and 10 mg vials, priced at $499 for the first month of treatment, with subsequent refills available at slightly higher prices. This initiative is especially relevant for patients covered by Medicare or those whose employer-sponsored health plans do not extend coverage to obesity treatments. Pricing therapeutics in this manner seems to be a calculated effort to increase accessibility to individuals who otherwise find themselves at a disadvantage within the healthcare system.

This move also reflects a broader critique of the healthcare industry’s handling of obesity—a chronic condition that has long been overlooked in policy discussions. Patrik Jonsson, president of Eli Lilly’s diabetes and obesity division, articulated a commitment to provide affordable solutions for this demographic, emphasizing the need for comprehensive coverage similar to other chronic conditions. Such sentiments speak to a growing recognition of obesity as a significant public health issue, deserving of equal treatment concerning medical resources and insurance coverage.

One of the most significant changes in the Zepbound offering is the transition from the previously available single-dose autoinjector pens to syringe-dispensed vials. While the latter presents some logistical challenges—patients must draw the medication themselves, a step that differs from the convenience of an autoinjector—the decision seems to be grounded in practicality and production capabilities. Vials are easier to manufacture than autoinjectors, potentially leading to a more stable supply amidst growing demand.

Additionally, this shift could suggest a longer-term strategy focused on ensuring a sustainable increase in the availability of Zepbound, especially after the drug faced shortages that prompted many to seek less regulated alternatives from compounding pharmacies. While Eli Lilly does not perceive itself as in direct competition with these compounders, their rise indicates a gap in the market that Zepbound’s limited availability had created.

Eli Lilly’s announcement comes amidst evolving regulatory landscapes. With the U.S. Food and Drug Administration declaring the Zepbound supply shortage as resolved, there is a renewed focus on the legitimacy of compounding pharmacies that have been creating unapproved versions of the drug. Jonsson’s comments highlight not only the necessity for regulatory safety but also the rationale behind providing an FDA-approved option that maintains efficacy and quality.

Moreover, Eli Lilly’s proactive stance against the knockoffs emphasizes a commitment to patient safety—ensuring individuals are utilizing a product that has met rigorous standards rather than uncertain alternatives. The challenge now lies in convincing potential patients of the value of investing in an FDA-sanctioned product, especially when compounded versions may appear more accessible or affordable in a fragmented market.

As Eli Lilly expands its offerings through LillyDirect, which connects patients with telehealth resources for prescription eligibility, it represents a modern approach to healthcare delivery. This direct-to-consumer model capitalizes on the growing trend of telemedicine, allowing more patients to access essential treatments without the burdensome barriers traditionally associated with obtaining prescriptions.

Jonsson’s remarks concerning market uptake suggest gradual progress, although still a slight portion of the obesity market. While the introduction of higher doses is expected to attract more patients, continued education and awareness-building will be paramount as Eli Lilly navigates this transformative landscape.

Eli Lilly’s strategic response to the challenges surrounding Zepbound reflects an ongoing commitment to confront obesity not only as a medical issue but as a societal one. By prioritizing accessibility, affordability, and safety, Eli Lilly is positioning itself at the forefront of a changing oncology landscape and advocating for an increased presence of obesity treatments in standard health insurance policies. As the company explores new avenues for distribution and patient engagement, the success of Zepbound may well serve as a catalyst for broader changes in how obesity is approached within the healthcare system.