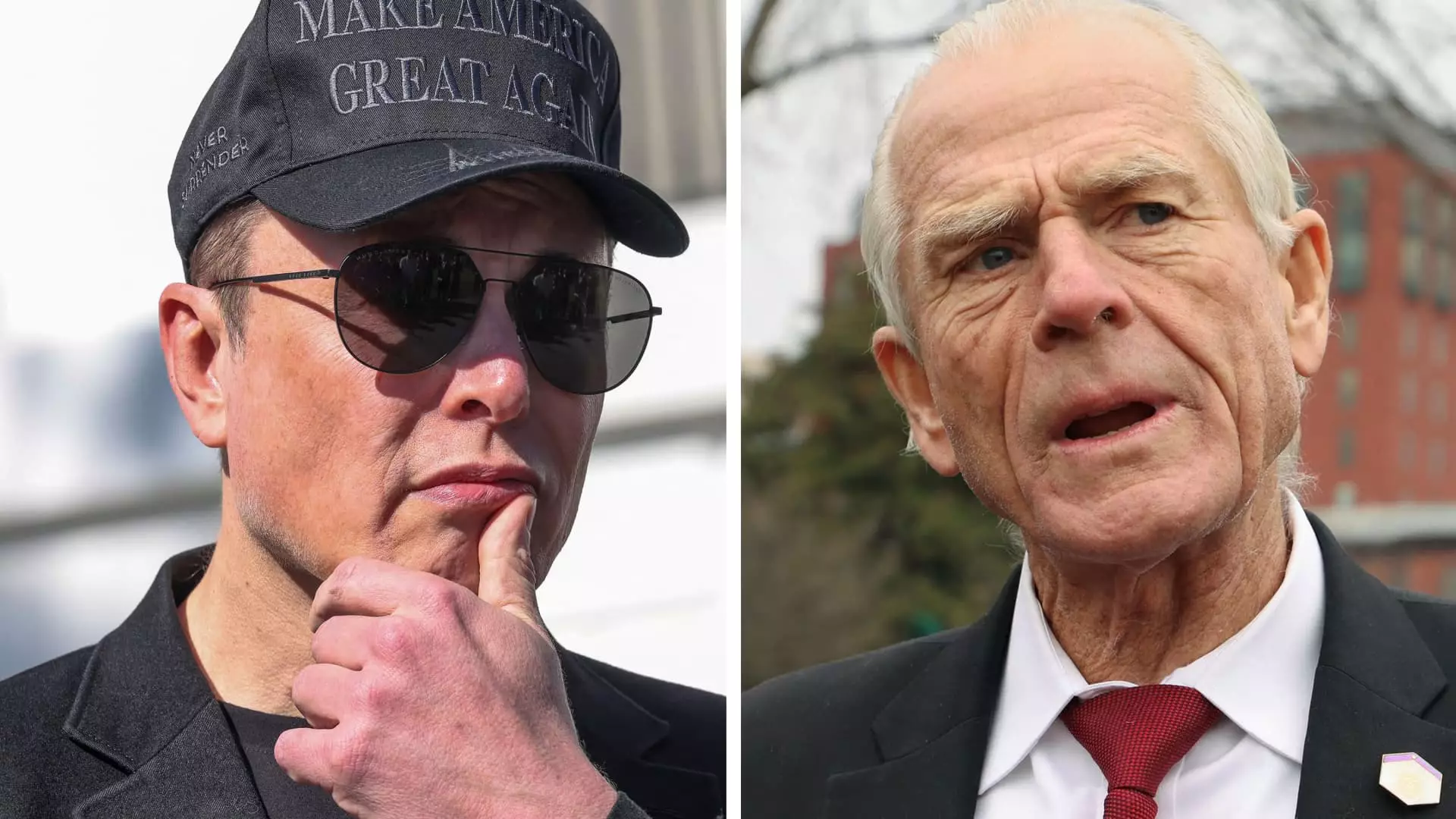

Elon Musk, the tech world’s controversial titan and the CEO of Tesla, finds himself embroiled in an unexpected and public feud with Peter Navarro, a key advisor in former President Donald Trump’s administration. This clash erupted just as Tesla’s stock continues its alarming descent—down 22% in recent days and an astonishing 45% year-to-date. Musk’s fiery comments, conveyed through a series of posts on X (formerly Twitter), paint a picture of a leader grappling with the consequences of both personal and public policy decisions, and highlighting a deeper malaise in American corporate governance.

What makes this spat noteworthy is not just the severity of the insults exchanged—Musk calling Navarro “dangerously dumb” and “dumber than a sack of bricks”—but rather the backdrop of a corporate landscape marred by crumbling stock prices and mounting tariffs. Musk’s remarks reflect a growing frustration within the business community regarding the unpredictable nature of trade policies, especially with Navarro’s recognition as a key advocate for heavily imposing tariffs. This rift indicates not only individual discord but also a fracturing alliance among those who should be united for sound economic policies.

The Consequences of Tariff Warfare

America finds itself in a contentious economic climate, where the administration’s broad tariffs on over 180 countries have stirred significant concerns among corporate leaders. Whereas Musk enjoyed a brief honeymoon with the political elite, the recent actions have laid bare the fissures within this alliance. Musk’s open criticisms are not merely personal jabs; they resonate with boatloads of anxiety from business leaders feeling the squeeze of rising production costs due to tariffs on materials sourced from global partners.

The tariffs have rendered it far more challenging for manufacturers like Tesla to thrive, even if some analysts proclaim Tesla’s domestic assembly as its saving grace. Musk’s comments on creating a meaningful “zero-tariff situation” with Europe are not just an idle wish; they are a desperate plea for a more favorable trading environment that fosters growth rather than stifling it. As Musk navigates this tumultuous landscape, he begs the question—are tariffs the right way forward for an economy that should be thriving on free trade and innovation?

Stock Market Turmoil and Public Perception

Musk’s corporate empire is certainly in a precarious position. As Tesla reported a 13% year-over-year decline in first-quarter deliveries, analysts’ fears for the company’s future appear justified. The stock’s catastrophic performance has erased over $585 billion in market capitalization, with paper losses mounting for Musk himself. Despite his ingenious ventures into electric vehicles and space exploration, Tesla’s current trajectory suggests a risk-averse future rather than the bold innovation we have come to expect from the visionary CEO.

Moreover, public perception around Musk has become a double-edged sword. His political involvement—having poured nearly $290 million into promoting Trump’s return to power—has attracted a slew of protests and boycotts targeting Tesla’s facilities. As individuals take a stand against what they perceive to be Musk’s politicization of corporate objectives, the fallout from this backlash indicates a vulnerability unlike anything seen in the past.

The Irony of Establishment and Rebellion

In a twist of irony, Musk, who has been labeled both a disruptor and a figurehead of corporate America, now finds himself leaning against the very establishment he has supported for so long. Engaging in this public feud with Navarro exposes Musk to the critique of not merely adopting a top-down approach typical of corporate leaders, but rather engaging in the messy, real-world consequences of his relationships with politicians.

It becomes apparent that Musk’s fate is intertwined not just with Tesla’s performance, but also with the evolving political landscape. As he juggles running multiple innovative companies including SpaceX and xAI, the fundamental question remains: what role will Musk choose to play in reshaping trade policies? The outcome of this very public feud reflects the broader narrative of connection and disarray as corporate giants are drawn into the cauldron of partisan politics.

Musk’s reign as the tech sector’s sovereign is on shaky ground as he navigates through a tempest of volatility, not only in stocks but in the very ideology that shapes American trade. In a time when leadership is needed most, Musk’s position serves as a litmus test for the crossroads of business, politics, and public sentiment.