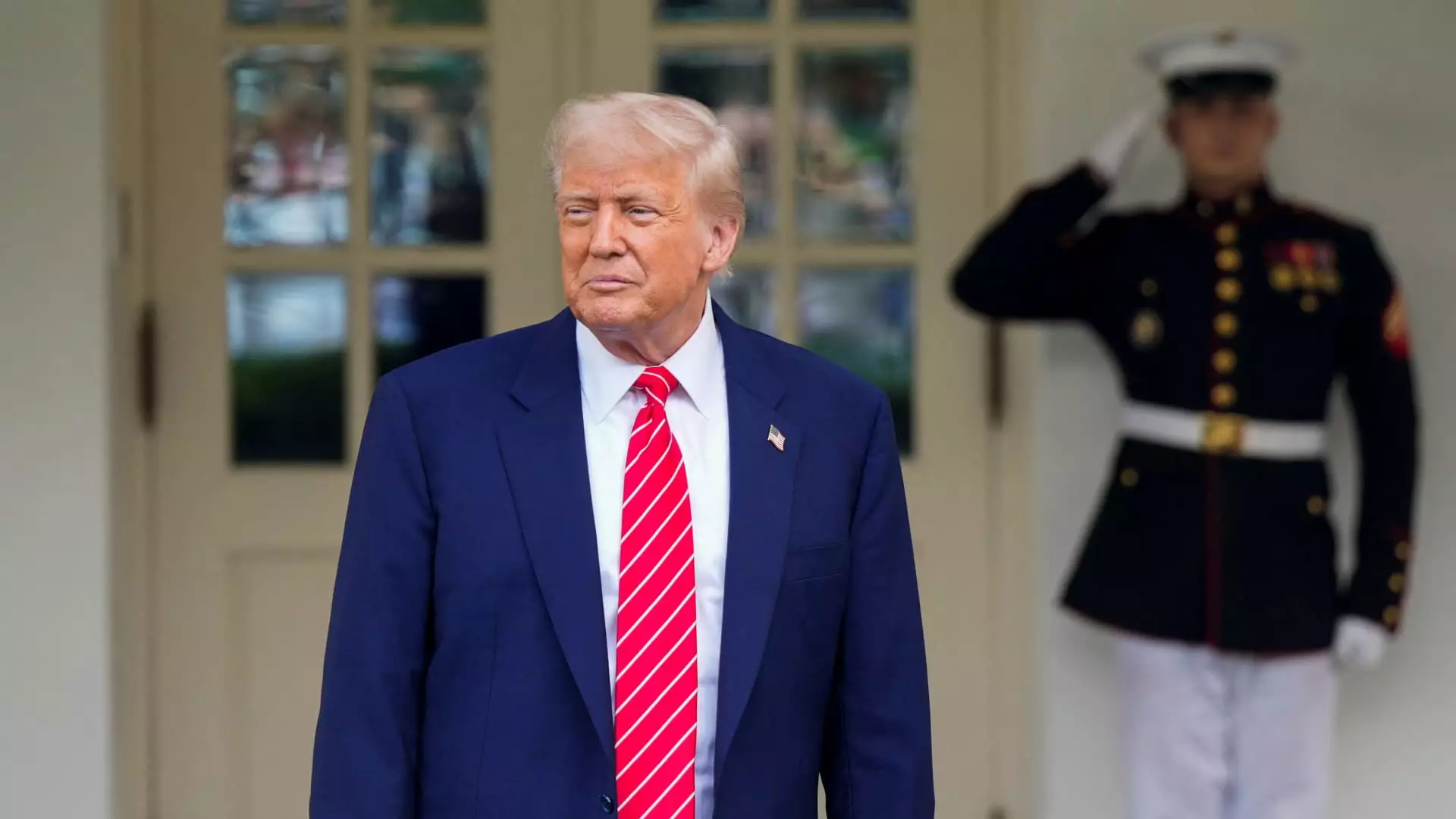

In an era where cryptocurrency is reshaping financial landscapes and garnering global intrigue, a tangled web of personal interests is thwarting progress in the United States. At the center of this turmoil is former President Donald Trump, whose active involvement in the crypto space has raised significant questions about transparency, governance, and ethics. As legislators grapple with the implications of a booming digital currency market, they find themselves confronted with an uphill battle, not only against opposition from the other side of the aisle but also against the pervasive shadow of Trump’s personal ventures.

The GENIUS Act: A Sought-After Solution Derailed

This week marked a critical moment for the potential regulation of stablecoins—the digital currencies pegged to physical assets like the U.S. dollar—when the much-anticipated GENIUS Act was rejected in the Senate. Originally designed to lay down federal guidelines for these cryptocurrencies, its failure to advance isn’t merely a reflection of partisan divisions but serves to illuminate the profound governance challenges posed by personal interests intertwined with public office.

Senator Jeff Merkley’s statements showcasing concerns about Trump profiting from his own cryptocurrency holdings encapsulate the essence of this issue. It’s not just a conflict of interest; it’s a grotesque blend of lobbying, personal profit, and public governance that puts national security at risk. The rationale behind stablecoin regulation is grounded in the need for consumer protection and financial stability, yet Trump’s financial incentives create confusion and skepticism, alienating those who genuinely want to cultivate a responsible crypto market.

Meme Coins and National Security Concerns

The heart of this conflict isn’t limited to the GENIUS Act alone; it extends to Trump’s launching of meme coins, especially the $TRUMP token, generating billions in speculative value. The ethicality of such ventures comes under scrutiny when significant promotions, like hosting dinners for top investors, emerge. This raises red flags regarding the chilling implications of “pay-for-play” schemes in how political power is wielded.

For many crypto enthusiasts and industry stakeholders, these controversies don’t just pose a hurdle for legislation; they compound fears about the U.S. relinquishing its leadership role in the rapidly evolving crypto market. Instead of advancing sound policies, lawmakers in Washington find themselves ensnared in the drama of personal gain over public good, which could ultimately cast the U.S. as a cautionary tale on the global stage.

Constitutional Values Tested by Financial Entanglements

The ethical dilemma is further exacerbated by the political dynamics at play. As Senate Democrats rallied around the “End Crypto Corruption Act,” led by Merkley and Minority Leader Chuck Schumer, they aimed not just to prevent politicians from endorsing digital assets but also to halt the erosion of public trust. Such initiatives symbolize a dire need for values rooted in accountability and integrity in a politically volatile setting, where personal ambition could undermine democratic principles.

Critics, including Senators Elizabeth Warren and Kirsten Gillibrand, have championed the necessity for strict regulations, emphasizing their importance for basic consumer protections and economic stability. The public deserves to know that their financial regulations are not being built on a foundation of corruption and self-dealing, yet Trump’s ongoing affiliations complicate any semblance of trust in legislative efficacy.

Investment and Innovation at Risk

Investor sentiment is intrinsically tied to political stability; ongoing uncertainties compromise not only investments but the broader perception of the U.S. crypto ecosystem internationally. The mishaps surrounding Trump-linked ventures could create an environment where foreign investors perceive the American crypto framework as riddled with pitfalls, dilemmas, and controversies, leading to an exodus of financial backing and limiting opportunities for innovation.

Ryan Gilbert of Launchpad Capital succinctly encapsulated this concern, highlighting the tragic irony that personal interests could obstruct meaningful progress in policymaking. The disarray seen now jeopardizes not only the broader cryptocurrency landscape but stifles entrepreneurship and the creative spirit that drives technological advancement.

The Path Forward: Dialogue Over Divisiveness

Moving forward, it’s essential for stakeholders to engage in earnest dialogue that transcends partisan divides. The ongoing discourse around cryptocurrencies requires lawmakers to prioritize clear, fair standards over speculative gains. If the political climate can shift from focusing on personal ambition to investing in collective future stability, perhaps a viable framework for digital assets can be birthed from this chaos.

Nevertheless, as it stands, the specter of Trump’s conflicts looms large over any prospect of legislative accomplishment. Navigating through this mess will demand transparency, integrity, and a recommitment to the pivotal democratic principles that are now being tested like never before. In fostering an environment where ethical governance prevails, the U.S. may mitigate potential reputational damage and reclaim its position as a leader in the dynamic world of cryptocurrency.