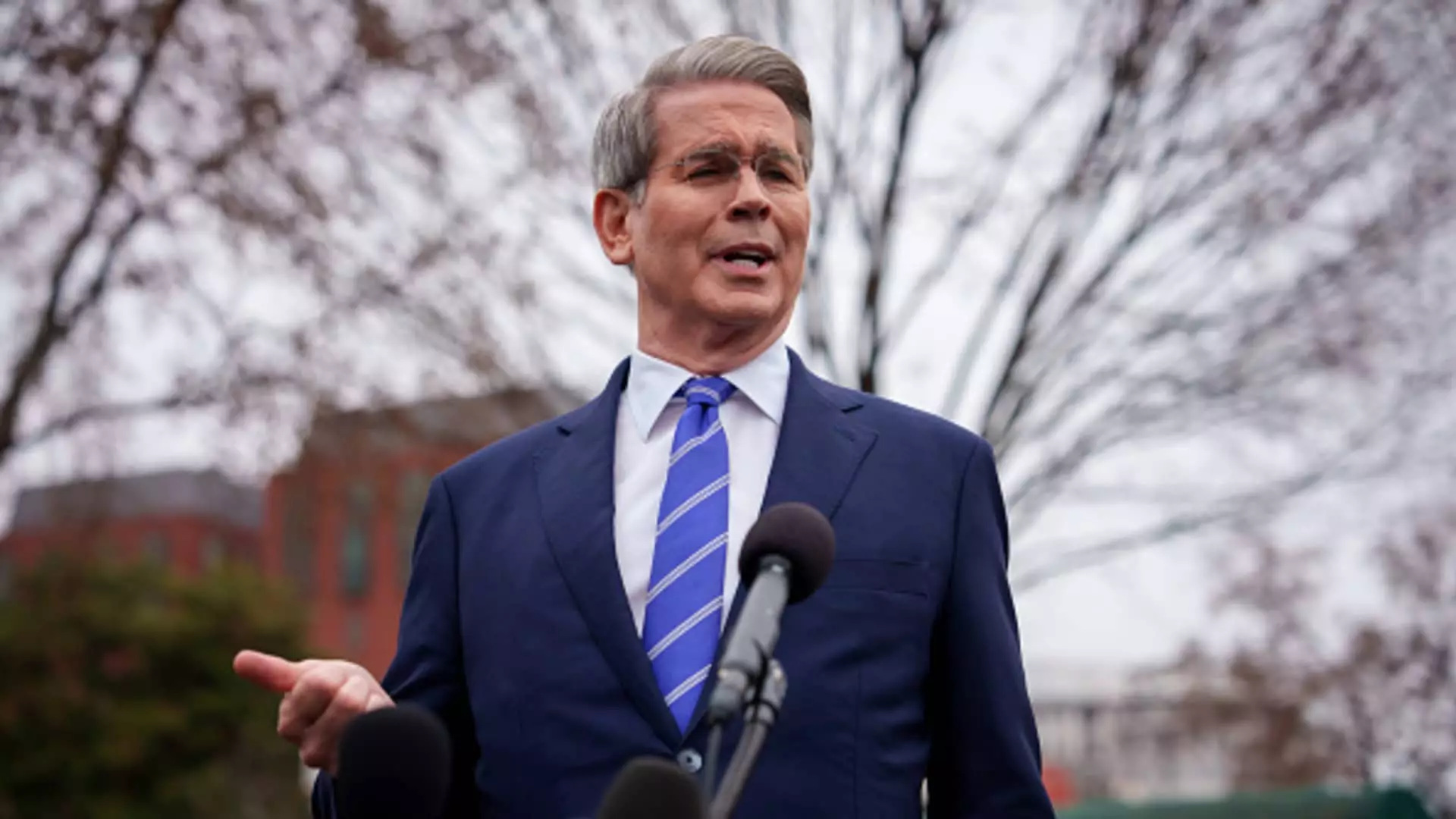

In what can only be described as a seismic shift within the technology sector, the recent sell-off has brought the so-called Magnificent 7 stocks—Apple, Amazon, Tesla, Alphabet, Microsoft, Meta, and Nvidia—to their knees. A staggering 13% decline from their peak in December signals a fraught moment not just for tech but for the economy at large. Treasury Secretary Scott Bessent attributes this downturn to the rise of a daring competitor: Chinese AI startup DeepSeek. This assertion arguably oversimplifies a far more complex situation, suggesting that a mere “mag problem” is the crux of the crisis. However, the reality is that this technological upheaval is a byproduct of deeper systemic issues, exacerbated by external economic pressures.

Widespread Economic Repercussions

The market’s volatile reaction isn’t solely due to DeepSeek’s disruptive AI models but also reflects a broader unease regarding President Trump’s aggressive tariff policies. These measures, widely criticized for their protectionist tendencies, have heightened fears of inflation and slowing economic growth. The stock market’s recent turmoil — with the S&P 500 plunging into correction territory — reveals a cascading effect where investor confidence is tenuous at best. The ambiguity surrounding future trade relations, alongside rising operational costs, is likely to inhibit corporate growth, particularly for those heavily invested in international markets.

Understanding the DeepSeek Disruption

DeepSeek’s advanced and economically appealing language models have triggered a crisis of confidence in the immense capital that American tech giants have funneled into AI. The suddenness of this disruption raises pressing questions about the sustainability of current innovation strategies within these companies. As they scramble to reassess their positions, the magnitude of this dismissal of American ingenuity becomes glaringly evident. If the capital markets treat AI like a mere commodity, the question arises: where does this leave U.S. companies that have long been cash cows in the tech domain?

The Disconnect Between Policy and Market Sentiment

Bessent’s comments downplaying the implications of tariffs strike a discordant note against the backdrop of Wall Street’s trepidation. When tariffs are positioned as a necessary evil in the name of “economic fairness,” the reality often diverges sharply from intention. These policies do not just threaten to accelerate inflation; they can stymie innovation and investments in sectors where the United States has traditionally held sway. Instead of fostering creativity and competition, they may inadvertently create insulating walls that could choke the very growth they aim to protect.

A Need for Pragmatic Solutions

Moving forward, the U.S. must navigate these turbulent waters with a balanced approach that acknowledges the high stakes involved. To re-establish faith in the market, it isn’t enough to dismiss challenges as transient or external—they need addressing through proactive policy changes that recognize both the power of American ingenuity and the reality of global competition. As another tech correction unfolds and the economic landscape changes drastically, it becomes crucial to prepare for a future shaped by both challenges and remarkable opportunities.